Gold prices have bottomed out, which present investors with a fantastic opportunity in this challenging environment.

That’s not unexpected if you haven’t been paying attention to gold. Very few investors have been. After failing to react to the quickly rising inflation in the U.S. and elsewhere, gold has lost a lot of its appeal.

The rate of inflation is at a 40-year high. However, gold, which is regarded as the best inflation hedge, is currently around a two-year low.

The recent troubles of gold have been mostly caused by what appears to be an unstoppable U.S. dollar rise.

The value of the dollar is close to a two-decade high, according to the U.S. Dollar Index.

However, there are several compelling reasons to be bullish on gold at the moment.

First, the surge started to halt last month on the U.S. Dollar Index’s shorter-term chart, which may be a warning that the greenback is about to reverse course.

Although a drop in the value of the U.S. dollar would undoubtedly benefit gold prices, there is currently a stronger argument in favour of gold bulls.

The two times of the year when gold prices usually do the best are at the end and beginning.

The gold market has a strong cyclical component. Gold cycles come in long, medium, and short varieties. The annual cycle of gold is, nevertheless, the most trustworthy.

To put it simply, gold has historically fared best during two times of the year. The first is a brief time frame from July to August, while the second is a term of four months from November to February.

Typically, the end of the summer and the start of the calendar year are the times when gold prices perform the best.

Why?

Well, the main factor is the expanding market for gold jewellery.

The demand for gold worldwide is mostly driven by the jewellery sector. Diwali is the biggest and most significant celebration for purchasing gold jewellery each year (the Indian festival of lights). Diwali was celebrated this year on October 24. Diwali may fall later on the calendar, but it is not the primary cause of the annual increase in gold prices. Instead, the other four significant global gold jewelry-buying holidays can be blamed for gold’s end-of-year surge.

Christmas is the major holiday. The National Retail Federation reports that Americans spend $1,000 on average on Christmas gifts and other holiday-related things. Any guy who is stumped for a gift for his wife or girlfriend usually opts for jewellery.

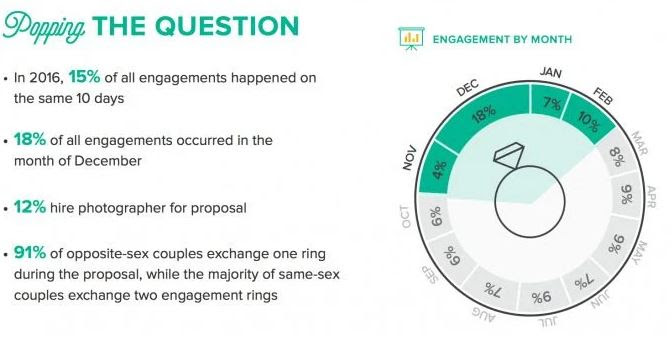

New Year’s Day is another holiday. Compared to Christmas, New Year’s Eve and New Year’s Day don’t have very high gold sales, but they are the fourth- and fifth-most popular days for engagements.

Christmas is the most common season for wedding engagements. 18% of all engagements, according to WomanGettingMarried.com, take place in December.

And then there is Valentine’s Day, which is the third most popular day for engagements and a day that really only exists to encourage diamond purchases.

Chinese New Year is another celebration that is linked to two colours. Red is considered to represent fire and provide happiness and good fortune. Gold is considered to bring wealth and prosperity because, well, it’s gold. Chinese New Year is also the biggest gold-buying holiday of the year.

Due to the proximity of all the holidays, there is normally a larger demand for gold jewellery during the four months of November through February. As a result, gold prices are typically higher during this period of the year.

So, now is the time to ride the wave, whether you’re investing in gold through real bullion, futures, ETFs, or options.